Raising funds for your side project 💰

Issue 10 🪜: Can your small side project be funded? Where to start from? How to reach out to investors? Here's everything you need to know.

Hey everyone👋, welcome to the 23rd newsletter.

Side projects can sometimes turn into a real passion when you have a clear vision & know if you really want to move forward with it. It’s true that most of them are just for a trial run as to learn from them but aren’t ready to take it to next level.

Yet, these multi-million or billion-dollar companies, now, back in time were a side project - Product hunt, Twitter, Gumroad, Github, Instagram, Slack, and more. Everyone started from somewhere and did not know if their side project will be the next unicorn. From bootstrapping to realizing they need funds to accelerate growth.

Many don’t realize that they don’t need an ultimate idea to raise funds. Yes, ideas take a certain percentage of investors’ decisions but it’s also your vision, execution, and strength to return 10x to the investors. Because that’s why they come to you. They believe that you and your product can give them a good ROI in the future.

This leads us to a question 🤔.

Does your product really need investment?

Till now you’ve successfully bootstrapped your product or at least worked on a scrappy MVP. That being said, most of the side projects don’t need investments. To understand if you really need investment, define why’s.

Are you building a technology that would take months or you aren’t an expert in building it? In most cases, if you aren’t a developer, you’ll need an engineering expert, or if you aren’t good at distribution & you need a marketing or sales expert.

You want to see growth & build a team. When you see good iteration and more customers/users are coming but to keep a hold on it & to expand it you need to build a solid team.

Ask yourself why you’re building it. Don’t say something like “just for fun”. Does the idea solve your own problem or you have found a loophole in the existing product? Do you already have users asking more about it or paying for it?

Imagine how would you see your product in the future. See if you have bigger goals, a clear vision & you’re ready to start from smaller ones.

When you aren’t 100% sure if that’s the job you want to do for the rest of your life and you take the risk to go the other way.

You’ve bootstrapped your project for so long which means you’re good with the limited resources, so why’s are always important. Because once you bring investors into your business it’s no longer only about your product growth, it’s a whole lot of responsibility and you can’t quit.

When you bootstrap you’re responsible for everything that happens in your startup and you don’t have to give accountability to anyone. But when someone puts their money into your product the responsibility changes and it’s no longer only about you.

When working alone, if things don’t work out great or out of some circumstances you no longer wish to move forward with the idea. You don’t have to explain it to anyone. But that doesn’t apply when you work with investors. So, when you want to raise don’t do it until you really want to.

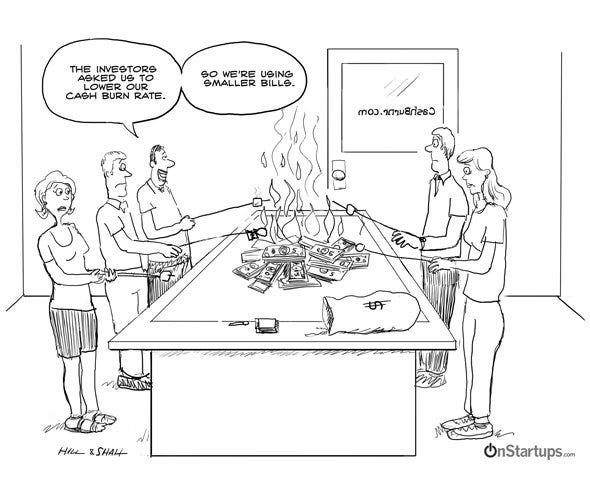

Sit down and understand why you need investment? Where are you going to put that money - is it hiring more people, advertising, marketing, expanding, etc. If you don’t know where you’re going to put your money you’ll just cash out quickly. And that happens with most of the founders.

But let’s say you’re all prepared and have tested the water, and you really want investment to move further. What’s next?

How much to raise & where to use it?

You need a specific number. If your product only needs a few thousand you can’t look for millions. The approach changes completely. When you know the amount you want, you’ll be looking in the right direction:

Target the right investors - angel investors, crowdfunds, VCs, etc. (see below).

Having too much money or too little money can destroy your product. What if you need $100k and you only raised $50k, how are you going to cover up expenses? What if you only needed $50k but raised $100k, do you know how to manage the funds? For this see where you’ll be spending money - development, marketing, team, sales, ads, etc. Have an estimate of every area you’ll spend money on and then add 25% more on it.

Once you know how much money you need and which type of investors to target, your approach will be different for a few hundred grand than a million dollars.

Start by describing the product goals (the first milestone), what will it take to reach there, and then define an estimated time you’ll need to reach the goal. Say, you need 18-24 months to reach the first milestone, then be prepared to raise enough that lasts for 24-30 months.

Why? Because a). Things don’t go as planned most of the time. If something holds up, you don’t want to start looking for more funds in between b). Even if you reach your goals on time, you’ll need enough cash to start working on the next milestone before raising another round or at least thinking about it.

Prepare a pitch & deck

Prepare a pitch

When I gave my first pitch, I did make some mistakes but after each intro, I changed it to make it better. Though, most investors don’t give you a reason on why they say “no” but after a while, you yourself understand where you’re going wrong.

Before investor even decides to show some interest in your product, they’ll see your pitch. When you email them, if you can’t hook them with the one-liner or introduction, they won’t even open your pitch.

So, a one-liner is your ride or die.

When going with the email intro be good with these following elements:

Product name and one line to describe your product. Make it small & cut the crab.

Describe the problem it solves in one line.

Has it gained any numbers or stats, MRR, ARR, users, etc? Show the traction.

A sentence about the market & future opportunity.

Lastly, if you have a prominent team member, add them (optional).

Remember, you aren’t selling your product to investors as a user but you’re actually asking for their money. You are not trying to convince them to use your product but showing them how people love using your product and why they should invest in it.

So, make sure your one-line is helping with it and leave the investors wanting to hear more.

Here's an example of cold email to send: Meagan James, founder of SaaSco, which helps marketers create marketing campaign based on a AI mechanism. The tool will ask some questions and automatically create which marketing campaign will work for the brand. Since it's beta launch, few months ago, it has grown the user base by 10% weekly and has already featured in xyz in the US. The product charge $20 per monthly subscription fee and is tackling a $10B market. I'm raising a seed round and would love to talk to you.

Prepare a deck

Once you get the investor interested, you need to be ready with your pitch deck. Usually, you’ll have to visit (also virtually) and present your product to hundreds of investors before hearing yes from a few.

Here’s what to keep in mind when preparing your deck:

Mention problems that you are solving through the product and what are the solutions.

If you’ve already created the product, show the prototype. Show some images of your product, or how does it work.

Talk about your users and target audience. If you’ve got a list of users already and have some paying customers, show the numbers. (Because numbers and stats makes a huge effect)

List of competitors, because you have them, and why you’re better than them.

You’ll get only a few minutes to pitch your product so make sure your slide is small and covers the important parts. Don’t make it longer than 10-12 slides.

In the end, show how much are you looking to raise and what are your terms.

Watch this video on how to create a pitch deck 👇🏻:

Reach out to investors

As I’ve said before, the amount of funds you need will define the type of investor you’ll need. Here are four areas you can start your search:

Fellowship programs

There are plenty of grants and fellowship programs in every industry and even those that specifically fund niche-based founders. If you’re looking to raise less than $10k, this is the best option. Product Hunt and OnDeck are some examples.

Crowdfunding

Crowdfunding is taking a small loan or capital from a large number of investors/individuals at the same time to invest in the business. Some of the most popular crowdfunding are Overlooked Ventures, Backstage Capital, and Republic.

Angel investment

Angel investors are individuals with extra cash in hand. You can find each for a specific industry, say if you’re building a product that is community-led, Lolita Taub and Greg Isenberg are the ones to reach out. They look for businesses that have the potential to grow and invest their money accordingly. If you’re looking for something less than $100k, reach out to angel investors.

VC investment

VC is a private equity financing option and is provided by venture capital firms or investors to new companies that have the ability for long-term growth potential. Through VCs, you can raise multiple million-dollar rounds - YC, 500 Startups, Hustle Fund VC, Initialized Capital, etc.

I’ve created this first-time founder’s resources where you can find a huge list of investors of all types with how to contact them and more information.

Side projects are a way to experiment, get inspiration, learn, and in many cases, they are just better than other business ideas. All you need to do is believe that the idea is worth the next level, look at who’s using it (get some users), understand the market and what could be the future. And once you decide to expand, go for raising funds.

Until next time! 👋

👋 PS: I’m Ritika founder, product marketer and advisor for early-stage startups, find more here or connect with her here. If you’re a first-time founder looking for curated resources, download here. If you enjoyed this post, read the past issues here. You can also promote your product in this newsletter.

A big thanks for reading & sharing!